Thai game player analysis 2025

Thailand’s gaming industry has become a key driver of the country’s digital economy, supported by widespread internet access, mobile technology, and a new generation of tech-savvy consumers.

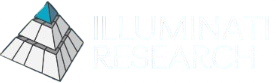

According to KResearch (2025), the market has grown steadily from 23 billion baht in 2019 to an estimated 36.1 billion baht in 2025. Although growth has slowed to 1.6% this year, the industry remains stable and resilient, offering continuous opportunities for revenue and innovation in the digital age.

Figure 1 (source: Kasikorn Research Center, 2025)

Players Group

Walk into any café in Thailand and you might see a group of friends huddled over their phones, battling monsters or racing cars. At home, someone’s older brother might be glued to his PC, deep in a strategy game, while a younger cousin unboxes a new Nintendo console with wide-eyed excitement.

This is the reality of Thailand’s gaming world—a diverse, ever-growing community made up of PC gamers, mobile players, and console lovers. From casual gamers who unwind after work to streamers sharing their gameplay with thousands online, each player brings a unique energy to the scene.

And beyond the fun, there’s a serious side too: E-Sports. With tournaments that offer fame, prize money, and even long-term careers, professional players are helping turn gaming into more than just a hobby—they’re shaping it into a thriving industry.

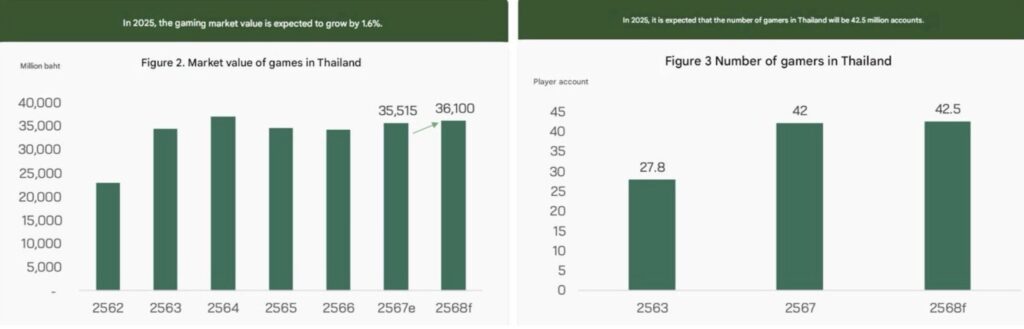

Figure 2

In a recent playtest for Monster Hunter, organized by Illuminati Research, 222 participants stepped into the world of digital monsters and strategy. The majority were male—making up 82% of the sample—while 18% were female, reflecting a common gender distribution seen in action-heavy titles.

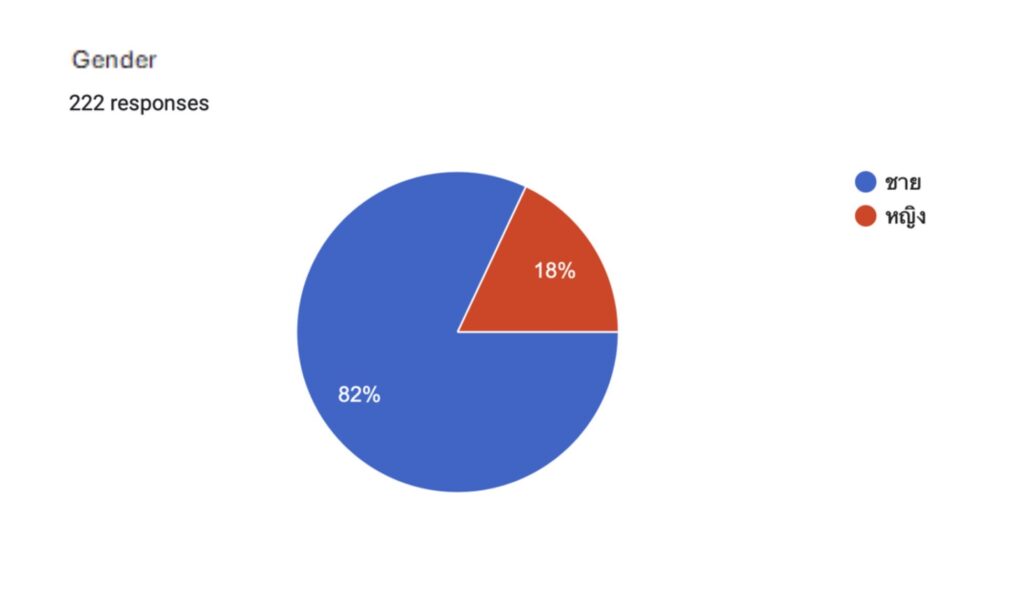

Most participants were between the ages of 18 and 35, with the youngest at 19. Interestingly, the age group with the highest representation was 28, accounting for 8.1% of the group. This was closely followed by players aged 22 and 24, each making up 7.2%.

Whether students juggling deadlines or office workers squeezing in gameplay between meetings, these participants reflect the modern gamer: young, dynamic, and deeply immersed in virtual worlds.

Figure 3

It’s no surprise that in Thailand—where smartphones are practically extensions of the hand—mobile games reign supreme.

Whether it’s a quick match during a lunch break or hours of adventuring on the weekend, mobile gaming has become the most popular platform in the country. According to data from Statista and KResearch (2025), revenue from mobile games is expected to hit USD 684.70 million, or roughly 24.997 billion baht, by the end of 2025.

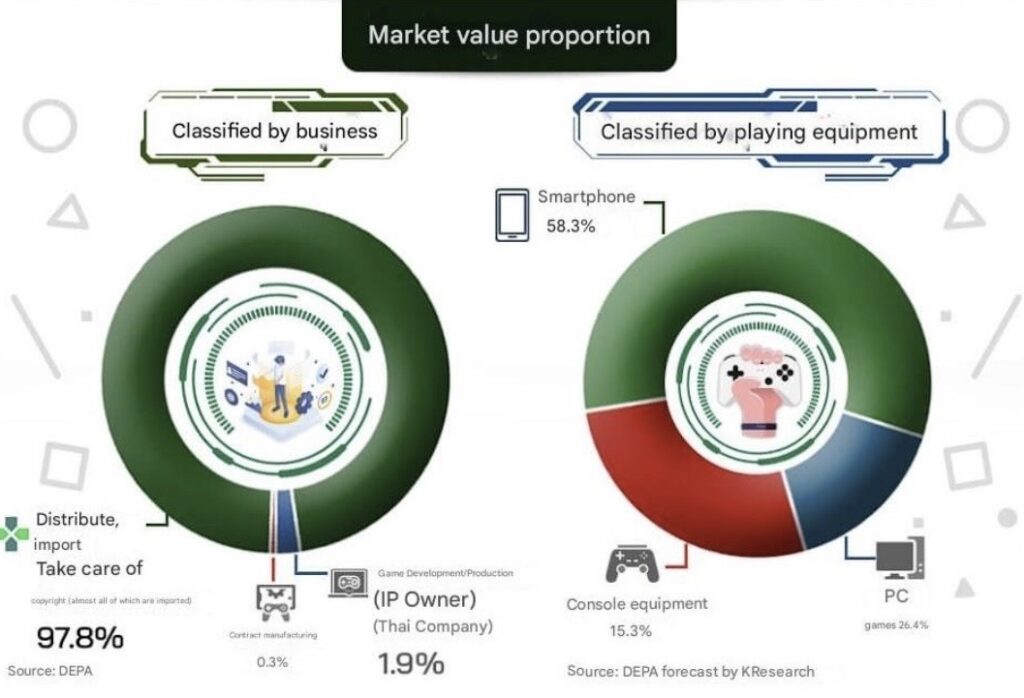

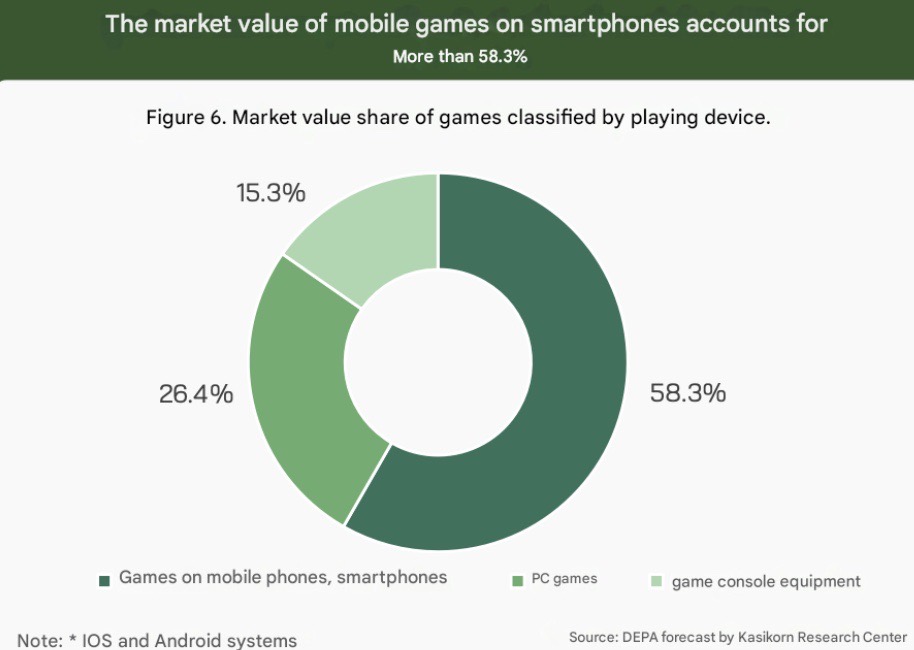

As shown in recent figures, mobile gamers now make up 58.3% of the market, followed by PC gamers at 26.4% and console players at 15.3%. And the trend is far from slowing down—with the number of mobile gamers in Thailand projected to reach 7.3 million by 2030.

With accessibility at its core, mobile gaming continues to shape how Thai people play, connect, and compete—anytime, anywhere.

Figure 4 (source: Kasikorn Research Center, 2025)

Popular Games

From fast-paced shooters to fantasy realms filled with magic, Thai players are drawn to a wide range of genres, each offering a unique way to play, compete, or simply escape. According to data from Inlingogames (2025) and Illuminati Research, the top five genres that dominate Thai screens are:

1. MOBA (Multiplayer Online Battle Arena) — Games like League of Legends, Dota 2, and Mobile Legends lead the charge, where teamwork, strategy, and real-time battles create endless excitement.

2. Shooters (FPS/TPS) — Titles such as PUBG, Free Fire, and Call of Duty: Mobile offer adrenaline-pumping action, attracting players who live for speed, precision, and survival.

3. RPGs & MMORPGs — For those who love immersive storytelling and character development, games like Monster Hunter, Genshin Impact, Ragnarok Online, and Lineage 2 remain all-time favorites.

4. Strategy Games — Thinkers and planners flock to games like Clash of Clans, Civilization, or even The Sims, where building, managing, and controlling outcomes is the ultimate goal.

5. Others — Casual and hypercasual games like mobile puzzles, endless runners, and card games fill the gaps in between, offering quick fun with minimal commitment.

Whether they’re conquering kingdoms, solving puzzles, or surviving fire fights, Thai gamers show a clear love for variety—proving that in gaming, there’s something for everyone.

Challenges Facing Thailand’s Gaming Industry

Beneath the bright lights of booming download numbers and million-baht tournaments, Thailand’s gaming industry faces its own set of challenges.

According to KResearch (2025), although the industry continues to grow, that growth is slowing. The number of new game accounts is projected to rise by just 1.2% from 2024—down from 3.6% the year before. One key factor: the economic slowdown, which has led some consumers to pull back on spending for games and in-game items.

But the bigger challenge lies in creation, not consumption.

Despite a strong player base, Thai game developers account for only 2% of the market value. The rest? It’s dominated by international titles. Thai gamers spend mostly on imported games, while local studios struggle to compete—held back by limited funding, a shortage of skilled talent, and fierce competition from global developers armed with cutting-edge tools like generative AI.

Many Thai-developed games remain under the radar, often confined to niche genres or mismatched with broader audience tastes. Meanwhile, foreign games continue to capture attention with bold marketing, constant innovation, and massive production budgets.

In short, Thailand is a powerhouse for playing, but still finding its footing when it comes to creating. For the industry to truly thrive, investment in local development, talent nurturing, and strategic support will be critical in leveling the playing field.

Opportunities on Thailand’s Gaming Horizon

While challenges remain, Thailand’s gaming industry is far from game over—especially when it comes to E-Sports.

This fast-growing sector continues to open doors for Thai gamers to step onto the global stage. Competitive tournaments like the RoV Pro League and Free Fire E-Sports not only draw massive viewership but also serve as launchpads for local players to become professionals, influencers, and even international stars.

Beyond entertainment, E-Sports is becoming a viable career path, offering prize money, sponsorship deals, and the chance to represent Thailand in global arenas. These events attract skilled players from across Asia and beyond, creating a dynamic ecosystem filled with fierce competition and opportunity.

With the right support—be it infrastructure, talent development, or investment—Thailand could become a regional powerhouse in E-Sports, turning passion into profession and gameplay into national pride.

Figure 5 (source: Kasikorn Research Center, 2025)

Future Trends: The Mobile Momentum

Looking ahead, mobile gaming is set to maintain its stronghold in Thailand’s gaming market. With over 58.3% of the total market value coming from iOS and Android platforms, the trend shows no sign of slowing down.

In fact, mobile games are projected to grow by another 1.8% from 2024—reflecting how players increasingly favor convenience, accessibility, and on-the-go entertainment. As smartphones become even more powerful and affordable, mobile gaming is expected to remain the heartbeat of Thailand’s digital play culture.

Figure 6 (source: Sensor Tower (2024)

Game On: Thailand’s Rising Role in Southeast Asia’s Gaming Scene

According to Sensor Tower (2024), Thai gamers spent the most on mobile games through In-App Purchases (IAP)—a trend that continues to rise. While mobile dominates with 58.3% of market share, spending on PC games (26.4%) and console/handheld titles (15.3%) is also growing steadily, fueled by players with higher purchasing power who invest in competitive play, updates, and in-game content.

Taken together, these insights point to one conclusion:

Thailand is one of Southeast Asia’s fastest-growing gaming markets.

With a tech-savvy, youth-driven population and a strong appetite for digital entertainment, the country is well-positioned to expand even further. If public and private sectors can come together to invest in infrastructure, empower local developers, and promote consistent E-Sports programming, Thailand has the potential to evolve from a gaming nation into a true regional hub.